In this post I would like to tackle the money problem, as it seems to be one of the most prevalent reason for an unhappy marriage.Many of Dr.Phil’s subjects seem to bring this problem up. You hear them say, she spends too much, or, he is stingy and so on…not very good, is it?

Many of us come out of our parents’ homes where everything is prepared and paid for, even when we share in the household costs.We have little or no budget responsibilities or need to balance the family income and expenses. We have an easy ride. Others have already taken the “freedom step’, and may then have a better insight of what is in front of them. However, the future is not assured and there are surprises galore on the way. So how does a couple manage their money, their income and expenses?

When we decided to get married, my mother said,

’ I have an x amount of money, do you want to spend it on a wedding, or do you want the money?’

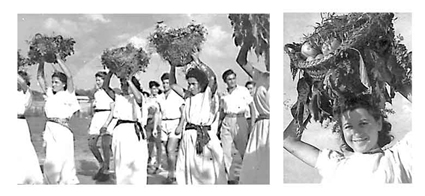

We opted for the money.Even though we took the money, we still had a small wedding in my parent’s apartment where relatives and parents’ friends were invited, followed by a ‘honey - week’ in place of a ‘honey - moon’.

Why did we opt for the money?

We knew that we needed it to put up a home.We also knew that we are not going to start marriage life lumbered with a debt, a proper reception would entail.We could not find a good reason to enslave ourselves for years just to be celebrities for one day. We felt, and still do, that debt in a young marriage is like a third person in the wedding bed, who will not leave; till kicked out with a penalty.

Money and its management is often what breaks a marriage, and an uncalled for debt puts unnecessary strain on any relationship; be it a young budding marriage, or a long standing one.With this strain often come back and fore accusations over who was the culprit responsible for creating this burden.

I know that it is fashionable nowadays to purchase everything a couple ‘deeds’ for life and pay for it with a credit card.Credit cards are expensive.

Firstly - one does not feel the money leave the wallet, and therefore it feels like a bottomless water well, that gives endless water, and one loses control and accountability.

Secondly - cards, in the main, carry high rates of interest when one does not repay the debt within an allotted time. As debt grows the accumulated interest incurred grows. This makes the purchased item more expensive, thus a higher debt.

Thirdly - when reckoning day comes, and it is sure to come, the awakening is rough, and one may lose everything one has.

We must remember that credit card companies are not philanthropies; they are here to make money.

The question is, can one do without buying on credit, without going into debt? What does a young couple really need to begin with? One thing is for sure; it does not need debt.We slept on mattresses on the floor for 2 years and it did not worry us. Not only that, but we had fun putting cent to cent together for purchases we wanted, and felt achievement once we could afford them.

Our daughter in law even had a ‘Glory Box’ where she collected things for the home in her bachelor days. Things like sheets, kitchen appliances, eating utensils and so on, which eased their starting days burden.

The only debt we did take on was for the purchase of a home and a second hand fridge.

So how does one deal with this problem?

What we did was that we transferred whatever money each of us had into a one joint account, and into which our incomes would go. Then, we made a budget book. This we divided into 2 main sections, one for income the other for expenses. Next we made a list of expected regular outgoing like council rate, water, electricity etc. added up the amounts and divided the result by 52, because Australian wages are paid weekly.This told us what amounts to put aside, plus about half as much again, in case we miscalculated. Then we decided on the percentage of income we can afford saving for rainy day.This we banked into a separate saving account, not to be touched. This was for us very important, and proved to be so in later days.

The rest was for our daily life.For that, we listed the items we need like food, clothing and so on in our expenses section, and were ready.

If and when one of us wanted or needed to spend on or buy something that was not essential, we always sought the other’s approval.This was, and still is, usually granted without hesitation.It was not a requirement, neither was it prearranged. It was, and still is, just curtesy that came automatically; due to the respect we have to one another.We could do that, because we knew that we both care and want success and advancement in our marriage; and neither of us would abuse this privilege.

Some may say, well, you had a lot of money to be able to do that, and I want to put your mind at rest.No we did not.We just tightened the belt, because we knew where we want to go.We often had just one meagre income and at times none at all, when we had to rely on what we have put away.But we had determination to do better.We wanted to succeed.

In my next posting on this subject, I will look into some of the other matters that make a marriage like, work and house hold etc.

Before I go,

My next posting, on whatever subject, will be delayed by about a week to ten days or so.In few days time my husband and I are heading back home and we are now packing.

Comments are welcomed

Renate,

Artist, poet and the author of

‘From the Promised Land to The Lucky Country’ – Renate’s book

2 comments:

Good advice... my parents did the same thing too, and my dad has given me the same advice. I guess it works (since like you, my parents are still married ;-) ).

Hi Eve,

Sorry to have taken so long to reply, but I just now (5 minutes ago) got my internet connected.

Pleased to learn your parents are still married. It is very important for every son or daughter to have the parents together in a loving relationship.

Good money management is extremely important in marriage.

I will be writing more about the subject of marriage in the near futue. in the meantime, I hope you are enjoying my other posts as well.

renate

Post a Comment